Global streaming giants – Netflix India, Amazon Prime, and Disney, which owns Hotstar, among others – all have their eyes set on India’s soon-to-be US$5 billion video-on-demand (VOD) market. So, it’s not surprising when Amazon founder and CEO Jeff Bezos, on his three-day visit to India on Thursday, said Amazon will double down on its investment in the country as “there is nowhere that the streaming service is doing better than India.”

To catch up with the competitors, Bezos announced the launch of seven new local content out of 24 new releases that are marked for India.

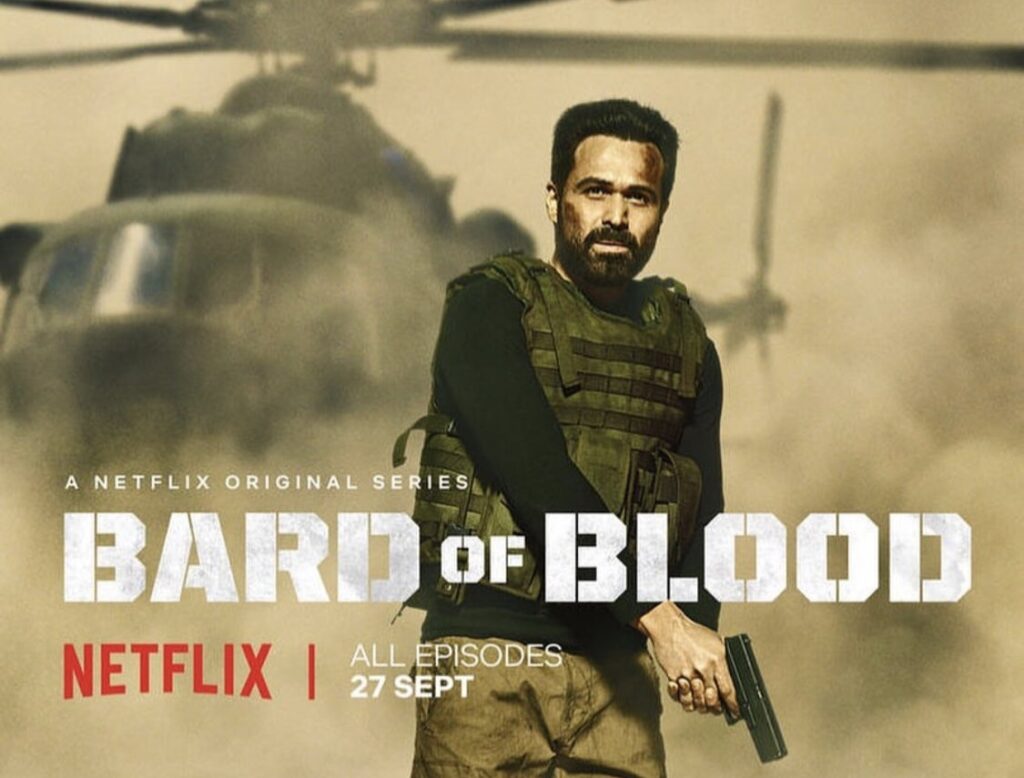

While all the companies are fighting for the larger pie of the market share, Netflix has been the most interesting case with its local experiments and India-only strategies, as even after three years of operations in the country, the American media services giant trails behind Hotstar and Amazon Prime. According to data-driven research platform Oddup, as of October 2019, Netflix had about 5% market share, while Hotstar enjoyed a 29% market share, followed by Amazon Prime’s 10%.

As the battleground for video-streaming services shifts from the US to the world’s second most populous country, India may turn out to be the last frontier for Netflix, which is already in a dire situation in its home market.

“Netflix has exhausted its growth domestically, and with new market entrants in the fray, it is focusing on international growth, especially in India,” said Prabhu Ram, head of Industry Intelligence Group at CyberMedia Research (CMR).

According to Ram from CMR, with Hotstar and Amazon Prime pouring money on original local-language programs, and the likes of Apple TV+, Disney+, and YouTube Premium coming into play, Netflix is not only squeezed on the pricing front but it is also facing the pressure to retain a specific niche.

“In its quest to increase its base in India, Netflix has a real risk of losing its market relevance,” Ram said. “Netflix could potentially lose subscriber interest due to too much emphasis on Bollywood-anchored original productions, which Indian OTTs such as ALTBalaji, Voot, and Zee5 have mastered.”

“Given the slowing economy and unexpectedly increased competition from the likes of TikTok, Chinese OTT platform players such as iQiyi and Tencent Video have to look internationally for growth,” said Ram. “However, they are constrained by their lack of expertise beyond the Chinese-language programs. For them and other Chinese players, SEA and especially India represent a better bet.”

He said these players may look at investing in and producing local-language content, as well as leveraging Indian content (especially Indian-language movies) in China “for gaining market differentiation while retaining the existing customer base.”

Source: TechinAsia