China is the hub of the global smartphone manufacturing supply chain. In fact, it accounts for almost 85% of the mobile phone components imported into India. Roughly, 12% of semi-knocked down (SKD) components are being sourced locally. The dependency of the world, as well as of India, on China for electronics components, cannot be emphasised. Last month, the outbreak of the coronavirus in Wuhan, China, led to 100 deaths in China, and more than 4500 reported cases worldwide. This begs the question: Can coronavirus disrupt Indian smartphone industry?

*This article, originally published on January 30, 2020, has been updated with new primary market insights.

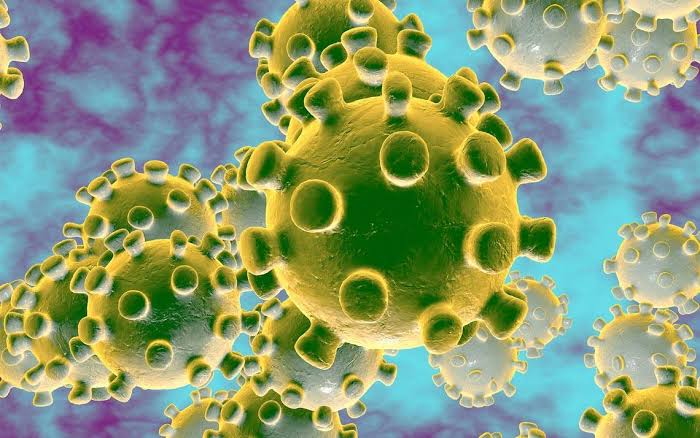

Before we delve further, we should take a step back, and look at what is the Coronavirus.

The coronavirus is a family of viruses that include the common cold, and viruses such as SARS (Severe Acute Respiratory Syndrome in 2003) and MERS (Middle East Respiratory Syndrome in 2012). This new coronavirus emanating from Wuhan has been named “2019-nCoV.” The coronavirus spreads through both direct and indirect contact, and can survive or stay suspended in the air for hours or travel more than a few feet. Just like SARS, this coronavirus can mutate along the way, and become potentially more virulent. Just like the SARS and MERS, the 2019-nCoV causes pneumonia, leading to the infection of one or both lungs. While the coronavirus infection starts off mildly with symptoms such as fever and fatigue, and accompanied by cough or diarrhoea, it could take almost a week for the infected person to seek medical help. In subsequent week, almost 30% cases are admitted to the intensive care unit (ICU) for mechanical ventilation. Further complications include septic shock and cardiac injury.

So, how will the coronavirus impact Indian smartphone supply chain?

The India smartphone market has benefited from Make in India, with many new manufacturing plants being established over the past few years. However, despite all the progress, for mobile phone players in India, China remains the key source for sourcing all critical components of a smartphone, including smartphone displays and printed circuit boards (PCBs). In 2019, for instance, the mobile phone components imported from China accounted for roughly US$ 10-12 Billion in terms of value.

While Indian players traditionally do account for a slowdown in component shipments from China owing to Chinese New Year festivities, they would now need to prepare themselves, and factor-in the extended shutdown arising from coronavirus. If employees at major smartphone component manufacturing hubs in China are restricted, these could further acerbate the shutdown.

For smartphone brands, such as Apple, the year ahead is potentially slated to be a blockbuster year in India, with good headroom for market growth through its strong product line-up or its offline-online retail play through Apple-owned flagship stores and through its online store. Given the high stakes, Apple would have to carefully watch how the coronavirus outbreak plays out. Similarly, Chinese brands in India would need to keep a close tab on the coronavirus-related developments.

Ultimately, the extent and the spread of the coronavirus-inflicted production shutdown in China will determine its impact on the Indian smartphone industry, including delays in new smartphone launches and ongoing smartphone production, as well as increase, if any, in product prices. If the situation persists, this could potentially contribute to component prices increasing by 3-4%, and even higher. All said, 1H 2020 would need to be closely watched for the coronavirus impact.

[Update: February 16, 2020: Components demand outstrips available supply]

With the demand for smartphone components far outstripping available supply owing to closure of factories in China, I believe the real impact will come in the second quarter, especially as early as from mid- to end-March onwards. The reliance on China also means that it will be potentially tough to attain agility in the short-term, and source alternate sources for component supplies. What this, in turn, translates into is that new product launches will see limited runs for now, and there is also the prospect of prices going up further. However, the smartphone market leaders in India should be able to weather the crisis. A big if remains on how soon China returns to normalcy.

[Update: February 17, 2020: Feature phones will be massively hit in Q1 2020]

Feature phone market will be hit by the Coronavirus disruption, as most feature phones are manufactured in China. with a potential upside of prices raising by around 8-10%.

[Update: February 18, 2020: Apple issues market guidance]

Apple has confirmed that it would be missing its second quarter guidance owing to he coronavirus outbreak, that has caused disruption in its iPhone supply chain. In addition, the temporary closure of Apple stores in India and a consequent lowering demand in China have also impacted Apple.

The first is that worldwide iPhone supply will be temporarily constrained. While our iPhone manufacturing partner sites are located outside the Hubei province — and while all of these facilities have reopened — they are ramping up more slowly than we had anticipated. The health and well-being of every person who helps make these products possible is our paramount priority, and we are working in close consultation with our suppliers and public health experts as this ramp continues. These iPhone supply shortages will temporarily affect revenues worldwide.